Price leadership

A price charged by the dominant producer that becomes the price adopted by all the other producers.

Copyright © 2012, Campbell R. Harvey. All Rights Reserved.

Price Leadership

A situation in which a company sets a price for a product and this company's market share and/or brand loyalty is so strong that other companies are compelled to match or beat the price. The company that first changes the price is said to show price leadership.

Farlex Financial Dictionary. © 2012 Farlex, Inc. All Rights Reserved

price leadership

a situation where a particular supplier is generally accepted by other suppliers as the ‘lead’ firm in changing market PRICES. Price leadership systems are often seen by suppliers as a useful way of coordinating their price policies so as to limit price competition and avoid ruinous price wars (see OLIGOPOLY). They may, however, act as a cloak for COLLUSION, and as such operate in a way detrimental to the interests of consumers. See MARKET CONDUCT, COMPETITION POLICY.Collins Dictionary of Business, 3rd ed. © 2002, 2005 C Pass, B Lowes, A Pendleton, L Chadwick, D O’Reilly and M Afferson

price leadership

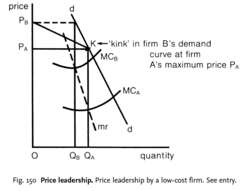

a means of coordinating oligopolistic price behaviour (see OLIGOPOLY), allowing firms whose fortunes are MUTUALLY INTERDEPENDENT to secure high profits. One example of price leadership is that of leadership by a DOMINANT FIRM (a dominant firm-price leader) possessing cost advantages over its competitors. In Fig. 150, firm A is the low-cost supplier, with a MARGINAL COST CURVE MCA; firm B has higher costs, with a marginal cost curve MCB. The individual demand curve of each firm is dd when they set identical prices (that is, it is assumed that total industry sales at each price are divided equally between the two firms); mr is the associated MARGINAL REVENUE curve. Firm A is able to maximize its profits by producing output OQA (where MCA = mr) at a price of OPA. Firm B would like to charge a higher price (OPB), but the best it can do is to ‘accept’ the price set by firm A, although this means less than maximum profit. For given firm B's conjecture about the reactions of firm A to any price change by itself, any alternative course of action would mean even less profit. If it were to charge a higher price than PA, it would lose sales to firm A (whose price is unchanged), moving left along a new ‘kinked’ demand curve segment KPB; if it were to cut its price below PA, this would force firm A to undertake matching price cuts, moving right along the demand-curve segment Kd. Firm B could not hope to win such a ‘PRICE WAR’ because of its higher costs. Thus, firm B's best course of action is to charge the same price as that established by firm A.Although price leadership systems are used by suppliers to avoid ruinous price competition, they may, however, act as a cloak for COLLUSION, leading to higher prices that exploit consumers. See COMPETITION POLICY.

Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005