Working capital

Working Capital

working capital

Working capital.

Working capital is the money that allows a corporation to function by providing cash to pay the bills and keep operations humming.

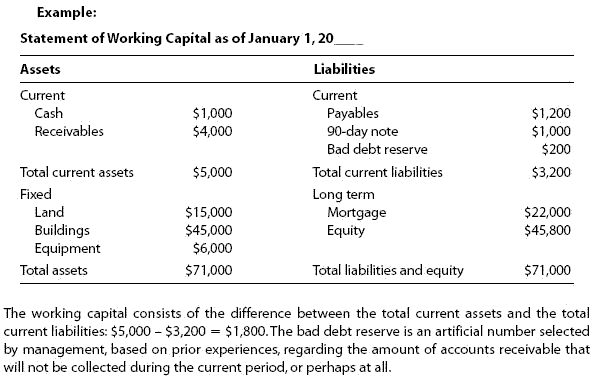

One way to evaluate working capital is the extent to which current assets, which can be readily turned into cash, exceed current liabilities, which must be paid within one year.

Some working capital is provided by earnings, but corporations can also get infusions of working capital by borrowing money, issuing bonds, and selling stock.

working capital

ornet current assets

An accounting term denoting a firm's short-term CURRENT ASSETS which are turned over fairly quickly in the course of business. They include raw materials, work in progress and finished goods STOCKS, DEBTORS and cash, less short-term CURRENT LIABILITIES. Fig. 90 shows the major components of the working capital cycle.Increases in the volume of company trading generally lead to increases in stocks and amounts owed by debtors, and so to an increase in working capital required (see OVERTRADING). Reductions in delays between paying for materials, converting them to products, selling them and getting cash in from customers, will tend to reduce the working capital needed. Decisions to hold larger than normal stocks to take advantage of bulk-order discounts or special prices, or in anticipation of materials scarcity, would tie up working capital. Increases in prices of materials or wage rates would also mean that extra working capital would be needed to cover INFLATION.

working capital

a firm's short-term CURRENT ASSETS, which are turned over fairly quickly in the course of business. They include raw materials, work-in-progress and finished goods STOCKS, DEBTORS and cash, less short-term CURRENT LIABILITIES. Increases in the volume of company trading generally lead to increases in stocks and amounts owed by debtors, and so to an increase in working capital required. Reductions in delays between paying for materials, converting them to products, selling them and getting cash in from customers will tend to reduce the working capital needed. See also OVERTRADING, CASH FLOW, CREDIT CONTROL, STOCK CONTROL, FACTORING.working capital

The difference between cash and other quick assets (current assets) and current liabilities.