Foreign Debt

international debt

the outstanding LOANS owed by borrowing countries to the WORLD BANK, INTERNATIONAL MONETARY FUND, CENTRAL BANKS and private sector COMMERCIAL BANKS, and other lending institutions.

international debt

the monies owed to the international community for providing loans in the form of ECONOMIC AID, mainly to DEVELOPING COUNTRIES, to finance their economic development programmes and loans to cover countries’ balance of payments deficits. Loans are provided both on a multilateral basis by international institutions such as the WORLD BANK and INTERNATIONAL MONETARY FUND and on abilateral, country-to-country basis. For the most part, international loans incur interest charges and have to be repaid in full over a specified redemption eriod.

International debt can play a useful role in facilitating economic development by providing funds to countries lacking domestic capital and helping countries with foreign exchange difficulties. From an individual country's perspective, modest levels of international debt are tolerable, but problems arise when a country becomes critically ‘debt-laden’. The failure of many developing countries to break out of the ‘poverty trap’ (arising from exploding population growth not matched by economic progress) has posed a big problem for the international community in recent years. For these countries, foreign exchange earnings are often insufficient to service annual interest charges, let alone pay off outstanding debt.

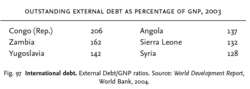

The World Bank has officially listed 41 countries as being ‘heavily indebted’. Fig. 97 shows the ratio of debt to current gross national product (GNP) for a number of these countries. In response to this situation, the World Bank has organized various debt ‘relief initiatives, encouraging its richer members to ‘write off debts wherever possible.

In 2003, outstanding loans to the developing countries amounted to more than $2,100 billion and annual interest charges on this debt amounted to some $300 billion.