Profit

After-tax income.

After-tax income, sometimes called post-tax dollars, is the amount of income you have left after federal income taxes (plus state and local income taxes, if they apply) have been withheld.

If you contribute to a nondeductible individual retirement account (IRA), a Roth IRA, or a 529 college savings plan, purchase an annuity, or invest in a taxable account, you are using after-tax income.

In contrast, if you contribute money to an employer sponsored retirement plan or flexible spending account, you are investing pretax income.

after-tax income

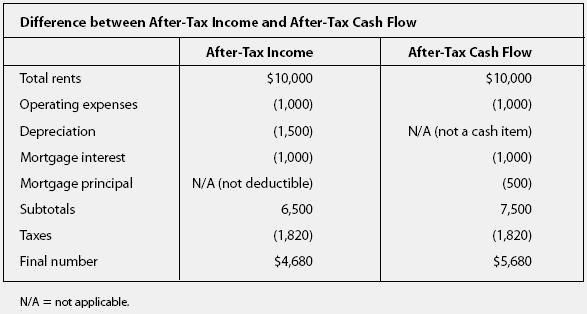

Income after deducting taxes.After-tax income is not the same thing as after-tax cash flow.The major difference between the two will usually occur because depreciation is a deduction from income but not cash flow.You don't write a check for depreciation.The other major difference arises because you write a check for mortgage principal payments, which reduces cash flow, but you can't deduct it,so it does not reduce taxable income.