Forecasting

Forecasting

forecasting

see SALES FORECASTING, TECHNOLOGICAL FORECASTING.Forecasting

The process of making predictions about future general economic and market conditions as a basis for decision-making by government and business. Various forecasting methods can be used to estimate future economic conditions, varying greatly in terms of their subjectivity, sophistication, data requirements and cost:- survey techniques, involving the use of interviews or mailed questionnaires asking consumers or industrial buyers about their future (buying) intentions. Alternatively, members of the sales force may provide estimates of future market sales, or industry experts can offer scenario-type forecasts about future market developments.

- experimental methods, providing demand forecasts for new products, etc., based on either the buying responses of small samples of panel consumers or large samples in test markets.

- EXTRAPOLATION methods, employing TIME-SERIES ANALYSIS, using past economic data to predict future economic trends. These methods implicitly assume that the historical relationships that have held in the past will continue to hold in the future, without examining causal relationships between the variables involved. Time-series data usually comprise: a long-run secular trend, with certain medium-term cyclical fluctuations; and short-term seasonal variations, affected by irregular, random influences. Techniques such as moving averages or exponential smoothing can be used to analyse and project such time series, though they are generally unable to predict sharp upturns or downturns in economic variables.

- Barometric forecasts to predict the future value of economic variables from the present values of particular statistical indicators which have a consistent relationship with these economic variables. Such LEADING INDICATORS as business capital investment plans and new house-building starts can be used as a barometer for forecasting values like economic activity levels or product demand, and they can be useful for predicting sharp changes in these values.

- INPUT-OUTPUT methods using input-output tables to show interrelationships between industries and to analyse how changes in demand conditions in one industry will be affected by changes in demand and supply conditions in other industries related to it. For example, car component manufacturers will need to estimate the future demand for cars and the future production plans of motorcar manufacturers who are their major customers. (f) ECONOMETRIC methods predicting future values of economic variables by examining other variables that are causally related to it. Econometric models link variables in the form of equations that can be estimated statistically and then used as a basis for forecasting. Judgement has to be exercised in identifying the INDEPENDENT VARIABLES that causally affect the DEPENDENT VARIABLE to be forecast. For example, in order to predict future quantity of a product demanded (Q d), we would formulate an equation linking it to product price (P) and disposable income (Y ):

then use past data to estimate the regression coefficients d, b and c (see REGRESSION ANALYSIS). Econometric models may consist of just one equation like this, but often in complex economic situations the independent variables in one equation are themselves influenced by other variables, so that many equations may be necessary to represent all the causal relationships involved. For example, the macroeconomic forecasting model used by the British Treasury to predict future economic activity levels has over 600 equations.

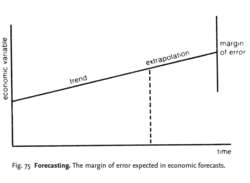

No forecasting method will generate completely accurate predictions, so when making any forecast we must allow for a margin of error in that forecast. In the situation illustrated in Fig. 75, we cannot make a precise estimate of the future value of an economic variable; rather, we must allow that there is a range of possible future outcomes centred on the forecast value, showing a range of values with their associated probability distribution. Consequently, forecasters need to exercise judgement in predicting future economic conditions, both in choosing which forecasting methods to use and in combining information from different forecasts.